Should you combine positions or signals? (Part II): Having your cake and eating it too

Do we actually have to extract assets' expected returns to harvest the benefits of factor model? Here we will talk about another approach where we can sum up our positions, and still integrate a factor risk model, without having to explicitly extract the expected returns of the underlying assets.

Sample code provided at the end of the post.

In the previous post, we talked about how by having positions of the signals, as well as their expected returns, we can extract expected returns of the assets. We noted that one of the reasons why we need to extract expected returns of the assets is because it allows us to integrate factor risk model naturally.

last post

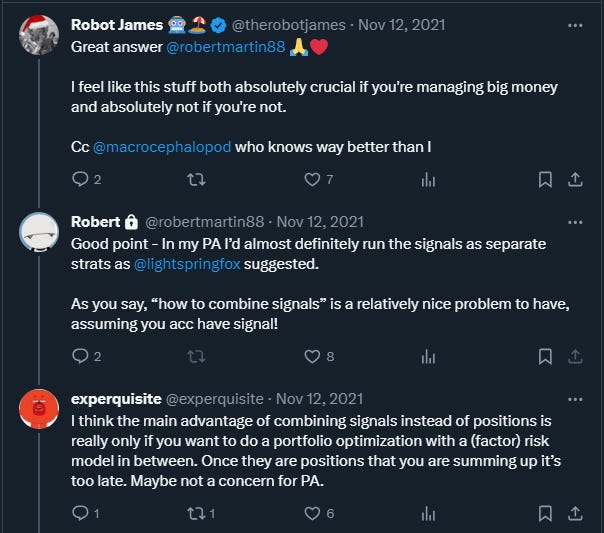

@experquisite made that point.

But do we actually have to extract assets' expected returns to harvest the benefits of factor model? Here we will talk about another approach where we can sum up our positions, and still integrate a factor risk model, without having to explicitly extract the expected returns of the underlying assets. And this method also allows a very clear way of attributing PNL, which can only be a good thing.