Paradox of Alpha Uncertainty

Why are you as an adult male, still say alpha errors matter more than covariance errors?

RT and fill up this form to get access:

\

If you have heard this saying: "Expected Returns misestimation matter way more, volatilities and correlations misestimations don't matter that much", the person who said this is probably is an NPC. But is it really true? (apparently it's not)

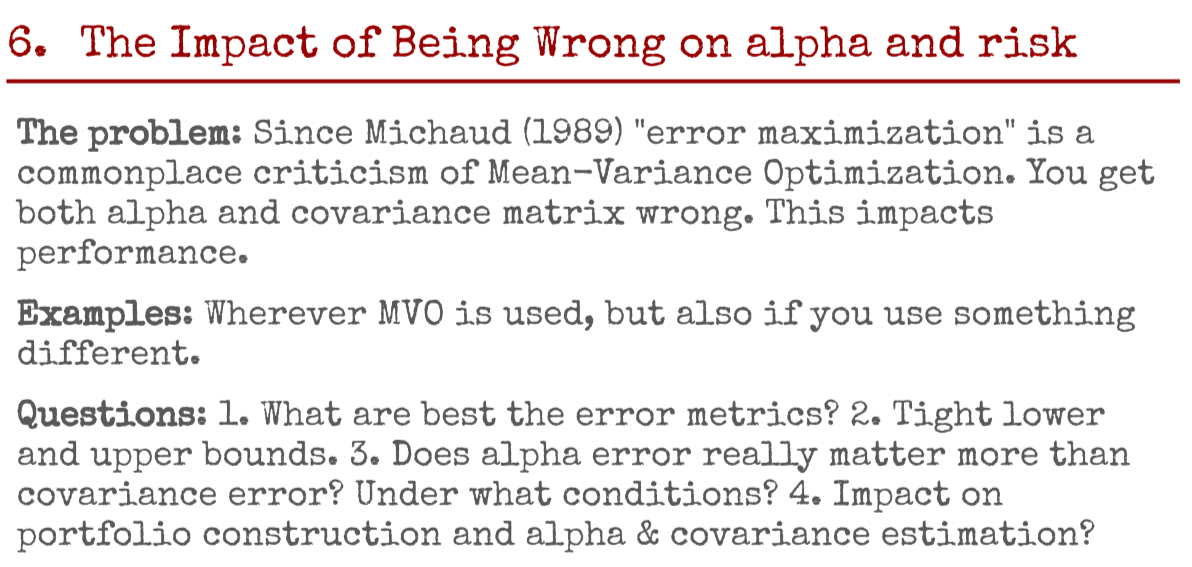

Interestingly, our beloved friend @__paleologo had a talk where the title was: Problems that keep me awake at night. And one of the problems was:

And coincidentally, I also think about the same problem a lot. No, Gappy and I are not the same person thanks for asking. Gappy actually already answered this question in his book, but if you're a crayon like me, the derivation is not so trivial to understand. So in this article I'm putting my neck out here and try to give a dumbed down version for us mortals, please be nice 😄

And on top of that, more counter-intuitively, we will show a paradox: the less you trust your expected returns vector, the more you should pull your weights towards the expected returns vector. Maybe doesn't sound too intuitive now, but it will make sense soon.

What the hell is an eigenportfolio?

Before we go deeper into the article, I just want to explain for the benefit of some of us who haven't encountered the term eigenportfolio yet, because it will be important later on. The explanation aims to provide intuition, versus just straight hardcore linear algebra stuffs (there will be some linear algebra though). Feel free to skip this part if you are well familiar with eigenportfolios.

10 is not finished. 7 is not super easy. But I like to believe it treats PCA with some respect, like adults in finance should.

— Giuseppe Paleologo (aka gappy) (@__paleologo) August 8, 2024

why are you as an adult male, not know what PCA is? jk I don't either.

I also previously wrote on how PCA affects portfolio optimisation specifically, but I've realised I haven't really written about the intuition behind PCA. Hence why I'm writing about it now.